All Excise And Taxation Inspector Paper 100 Mcqs with online solved exercises for the students. Solved Ppsc Past Paper Of Excise And Taxation Inspector with Answers.

New Mcqs Paper Excise And Taxation Inspector Eti Jobs Sample Paper For Ppsc Must Prepare Now with quiz test here also for better and easy preparations. All Ppsc Excise And Taxation Past Paper 2013 with Mcqs Related To Excise And Taxation Inspector.

There are a lot of exams NTS, PPSC OTS CSS and FPSC in which exams MCQs are mostly repeated. Here i am sharing with you important MCQs for the Posts of BPS 14 to BPS 18 Jobs of Govt by Pakistan Public Service Commissions.

Here is the list of MCQs in PDF Books. All most repeated MCQs in the Regular and Contract base jobs for the period of three years and Five years in the PPSC Jobs tests.

You have to need study and prepared these MCQs for the Exams tests of recruitment by mostly in Punjab and all over the Pakistan.

Excise Taxation job is regular by the PPSC announced in every year by the newspapers jobs ads.

Excise and Taxation tests are important to get 80+ marks in the tests if the candidate passed the test with good marks then the second stage is to clear the interview for getting the job.

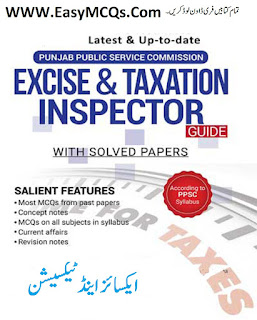

Excise And Taxation MCQs Book

There are many students who applied in all over the Pakistan and sometimes only Punjab Candidates are applied for the punjab domicile only. Keep in mind before any PPSC and NTS test. The candidate must keep time in mind and getting the full score in the exam if He/She is fully prepared the exam test.

New Mcqs Paper Excise And Taxation Inspector Eti Jobs Sample Paper For Ppsc Must Prepare Now with quiz test here also for better and easy preparations. All Ppsc Excise And Taxation Past Paper 2013 with Mcqs Related To Excise And Taxation Inspector.

|

| Excise and Taxation Inspector PDF Guide |

There are a lot of exams NTS, PPSC OTS CSS and FPSC in which exams MCQs are mostly repeated. Here i am sharing with you important MCQs for the Posts of BPS 14 to BPS 18 Jobs of Govt by Pakistan Public Service Commissions.

Here is the list of MCQs in PDF Books. All most repeated MCQs in the Regular and Contract base jobs for the period of three years and Five years in the PPSC Jobs tests.

You have to need study and prepared these MCQs for the Exams tests of recruitment by mostly in Punjab and all over the Pakistan.

Excise Taxation job is regular by the PPSC announced in every year by the newspapers jobs ads.

Excise and Taxation tests are important to get 80+ marks in the tests if the candidate passed the test with good marks then the second stage is to clear the interview for getting the job.

Excise And Taxation MCQs Book

Islamic MCQs Solved PDF Book Download Here

Excise and taxation Sindh Test, Excise and taxation Islamabad test, Excise and taxation lahore test, Excise and taxation kpk test, Excise and taxation Rawalpindi test, Excise and taxation Punjab token tax MCQs, Excise and taxation office lahore address and excise and taxation Islamabad token tax MCQs with Solved answers.There are many students who applied in all over the Pakistan and sometimes only Punjab Candidates are applied for the punjab domicile only. Keep in mind before any PPSC and NTS test. The candidate must keep time in mind and getting the full score in the exam if He/She is fully prepared the exam test.